Sales Tax Rate For Fresno Ca – The idea of “buying quality” is not just a luxury; it’s a mindset that encourages consumers to think beyond the momentary gratification of cheap purchases and focus instead on long-term value and satisfaction. These generations are more aware of the environmental impact of fast fashion, disposable goods, and the need to adopt more sustainable practices. When we begin to view everything through the lens of commerce, it’s easy to lose sight of the things that make life worth living — the moments that aren’t for sale, the experiences that can’t be bought. Negotiation is often the most delicate part of the sale process. After the sale is complete, the buyer assumes responsibility for the business and takes control of its day-to-day operations. We live in a society where people constantly trade their time for money, their expertise for compensation, their dreams for tangible rewards. There is also a growing trend of upcycling and repurposing second-hand goods, where items that may no longer serve their original purpose are transformed into something new and useful. Despite the many advantages of buying and selling second-hand goods, there are some challenges that both buyers and sellers must navigate. While many artists and creators are forced to sell their work in order to make a living, there is still a sense of purity in the act of creation. The notion suggests a world where anything and everything, regardless of its intrinsic value, can be bought, sold, or traded. It’s a world where even personal growth, self-actualization, and emotional healing are framed as commodities, available for purchase at any time, but only if you’re willing to pay the price. The concept of quality, however, is not a one-size-fits-all. Electronics are another category of second-hand goods that have seen a rise in popularity. However, it’s also important to recognize the darker side of this freedom. The second-hand market is not just about saving money; it’s about embracing a more sustainable, mindful way of consuming that values reuse, repurposing, and the stories behind the items we choose to keep. With the rising costs of new products, especially in categories like electronics, clothing, and furniture, purchasing second-hand items can offer significant savings. Yet, even within this system, there is room for hope. When a person decides to sell something, they might weigh the pros and cons, debating whether it’s the right time or whether it’s really necessary to part with what they’ve had for so long. In the end, the phrase “for sale” is about more than just the exchange of money for goods or services. The decision to sell an heirloom piece of furniture, for example, can be emotionally complex, as it involves a shift in one’s connection to the past.

California Sales Tax 2024 Schedule 2024 Norma Annmaria

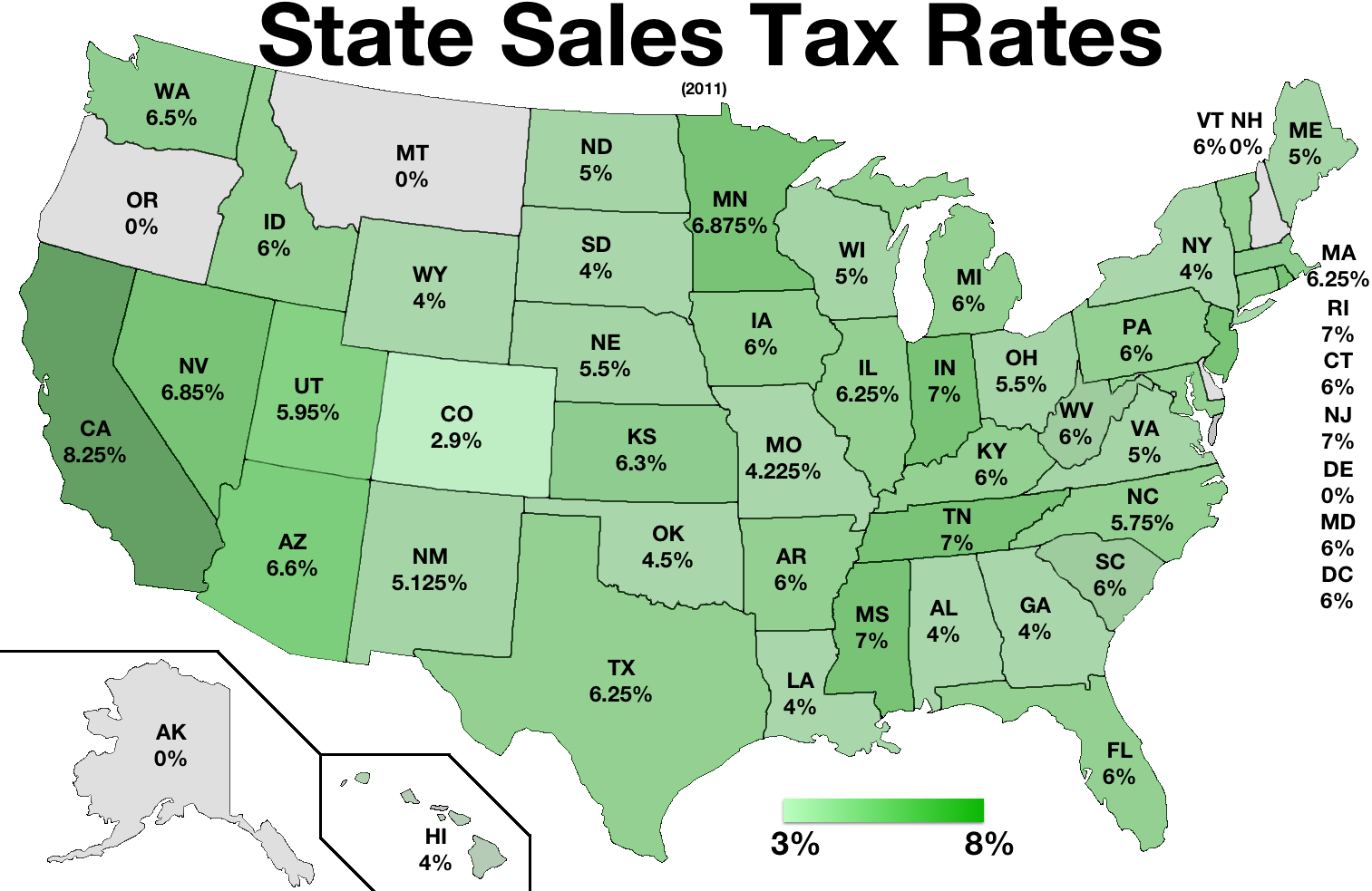

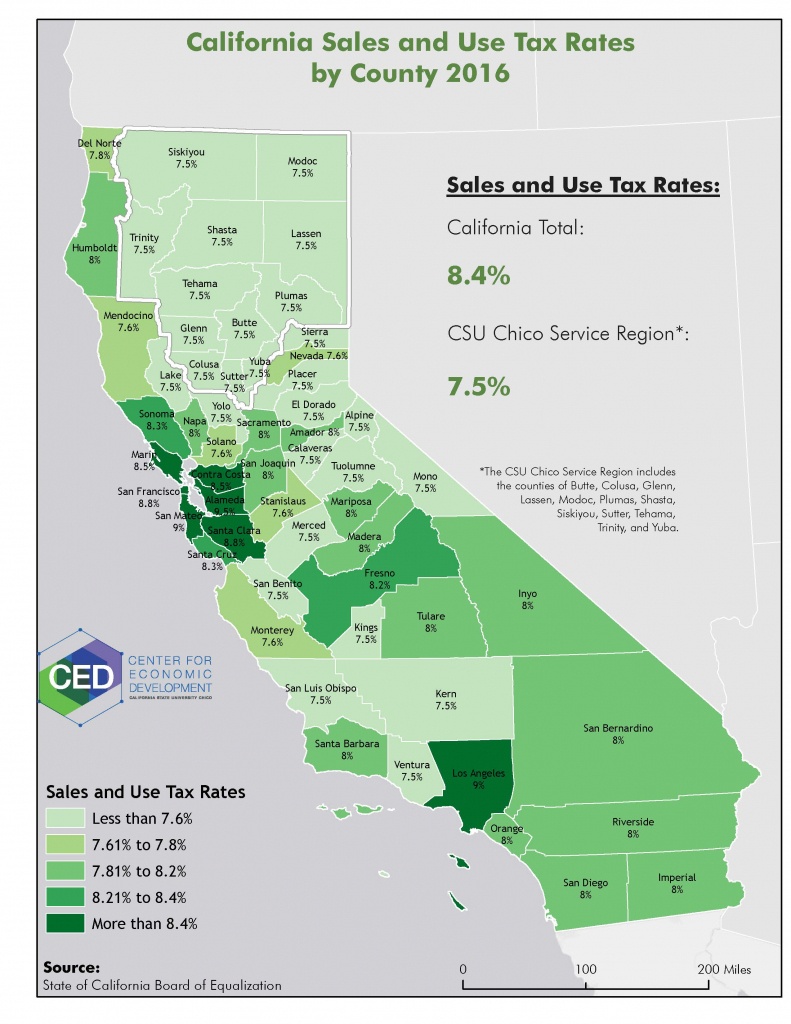

This is the total of state, county, and city sales tax rates. The total sales tax rate in fresno consists of the california state tax rate, fresno county tax rate, and additional city tax rates where applicable. The current sales tax rate in fresno county, ca is 9.23%. 547 rows for a list of your current and historical rates, go.

Get The Scoop California Sales Tax Rates Explained

The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.225% as of january 2025. This is the total of state, county, and city sales tax rates. The average cumulative sales tax rate in fresno county, california is 8.31% with a range that spans from 7.98% to 9.23%. The.

California Sales Tax Rates 2024 Table Catie Evangeline

The minimum combined 2025 sales tax rate for fresno, california is 7.98%. Check sales tax rates by cities in fresno county Fresno sales tax rate is 8.35%. The average cumulative sales tax rate in fresno county, california is 8.31% with a range that spans from 7.98% to 9.23%. The different sales tax rates like state sales tax, county tax rate.

Understanding California’s Sales Tax

These figures are the sum of the rates together on the state,. The combined sales tax rate for fresno city, california is 8.35%. The average cumulative sales tax rate in fresno, california is 8.34% with a range that spans from 7.98% to 8.35%. The state of california has a general sales tax rate of 6% which applies. This is the.

Fresno County Sales Taxes B to Z How Your Billions Are Being Spent

The december 2020 total local sales tax rate was 7.975%. The state of california has a general sales tax rate of 6% which applies. The current sales tax rate in fresno, ca is 7.98%. These figures are the sum of the rates together on the state, county, city, and. The current total local sales tax rate in fresno, ca is.

Sales Taxstate Here's How Much You're Really Paying California Sales

The current sales tax rate in fresno county, ca is 9.23%. The total sales tax rate in fresno consists of the california state tax rate, fresno county tax rate, and additional city tax rates where applicable. The local sales tax rate in fresno county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.225% as of.

California Sales Tax 2024 Calculator With Taxes Betsy Collette

These figures are the sum of the rates together on the state, county, city, and. Fresno, ca is in fresno county. These figures are the sum of the rates together on the state,. The total sales tax rate in fresno comprises the california state tax, the sales tax for fresno county, and any applicable special or district taxes. The california.

California Sales Tax Guide for Businesses

The december 2020 total local sales tax rate was also 7.975%. Fresno county, ca sales tax rate. The current sales tax rate in fresno for 2024 is 8.35%. Fresno, ca is in fresno county. The california sales tax rate is currently 6.0%.

Fresno County Sales Tax Rate 2024 Danni Sascha

The total sales tax rate in fresno comprises the california state tax, the sales tax for fresno county, and any applicable special or district taxes. What is the sales tax rate in fresno, ca? The different sales tax rates like state sales tax, county tax rate and city tax rate in fresno county are 6.00%, 0.25% and 0.84%. The current.

California Sales Tax Rates 2024 By County Aidan Zorine

The minimum combined 2025 sales tax rate for fresno, california is 7.98%. The total sales tax rate in fresno consists of the california state tax rate, fresno county tax rate, and additional city tax rates where applicable. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates.

These platforms allow users to browse listings, communicate with sellers, and make purchases from the comfort of their own homes. Thrifted clothing, vintage furniture, and pre-owned electronics are often seen as more authentic and unique than brand-new, mass-produced items. The idea that everything has a price, and that everything is for sale, may seem like a grim outlook, but it’s one that has become increasingly true. The rise of minimalism and a desire for unique, vintage items has also played a role in the growing popularity of second-hand goods. For those looking to sell, the online marketplace offers the chance to reach a larger audience, increasing the chances of finding the right buyer. In both cases, there’s a sense of vulnerability. Whether it's old furniture that no longer fits with their style, clothing that no longer fits, or electronics they no longer use, selling second-hand items allows individuals to recoup some of the money they spent on these goods. We are all participants in a vast, interconnected economy, one that doesn’t just involve physical goods but extends to ideas, relationships, and even identities. People are increasingly looking for quality over quantity, preferring items that are durable, timeless, and well-made. Legal experts are often involved at this stage to ensure that the transaction is conducted in compliance with all relevant laws and regulations. Selling such an item can be a difficult decision, yet it often represents the practical need to downsize or make space for something new. The internet, for example, has created a space where anyone can buy or sell almost anything, from physical products to intangible services. Online platforms such as eBay, Craigslist, and Facebook Marketplace have made it easier than ever for individuals to sell their unwanted items to a global audience. In conclusion, the sale of a business is a complex process that involves numerous steps, from identifying the right buyer or seller to completing due diligence and negotiating the terms of the transaction. The “for sale” sign becomes a marker in time, a decision that has been made, signaling that it’s time to move on. It forces us to ask difficult questions about ownership, worth, and the limits of human desire. Overpricing an item can lead to it sitting unsold, while underpricing it can result in lost potential revenue. When someone buys a second-hand item, whether it’s a piece of furniture passed down through generations or a retro jacket from a bygone era, they are not just acquiring an object; they are connecting to a story, a memory, or a cultural moment. The promise of success in a marketplace driven by capitalism can be an illusion for those who don’t have the resources or opportunities to compete on equal footing. On the other hand, traditional industries such as brick-and-mortar retail or manufacturing may face challenges, with many businesses in these sectors looking to sell or transition due to changing market conditions.

The practice of buying and selling second-hand items has been around for centuries, but in recent years, it has seen a resurgence. The ease and convenience of online sales have created a global marketplace where individuals can connect with buyers and sellers across the world. Upcycling is a great way to make the most out of second-hand goods, adding both value and meaning to the items that are being repurposed. Many second-hand clothing stores and online platforms specialize in curating high-quality, gently used apparel, making it easy for consumers to find fashionable items that align with their tastes. The advent of these online platforms means that consumers can hunt for items they might have otherwise overlooked or been unaware of, sometimes at a fraction of the original cost. They also have access to networks of potential buyers and sellers, which can help expedite the sale process and increase the chances of a successful transaction. It’s easy to understand why people seek out quality goods for sale. Perhaps the most troubling aspect of the idea that everything is for sale is how it can shape the way we view the world and each other. A well-made product simply performs better. The truth is that the idea of quality is deeply rooted in the philosophy of craftsmanship, heritage, and trust, which explains why certain items, often categorized as quality goods, tend to be prized more than others, even when they may come with a higher price tag. On the other hand, buyers may seek to negotiate lower terms based on the findings from their due diligence or their assessment of the business’s future potential. And, in a way, this is the ultimate form of freedom: the ability to buy, sell, and trade on your own terms. Take, for example, a high-quality piece of furniture — a well-crafted sofa or dining table can last for decades if maintained properly. Whether buying or selling, the process requires careful consideration, transparent communication, and a thorough understanding of both the financial and operational aspects of the business. In times of financial hardship, such as during recessions or periods of high unemployment, more people may turn to second-hand goods as a way to save money. They are investments, not just purchases, and their value is often felt long after the original transaction has ended. They believe that certain things, like love, loyalty, and friendship, should be above the reach of commerce. Legal experts are often involved at this stage to ensure that the transaction is conducted in compliance with all relevant laws and regulations. This revival can be attributed to a combination of economic factors, growing awareness of environmental issues, and a shift in consumer attitudes toward sustainability and the value of pre-owned items. Additionally, brick-and-mortar thrift stores and consignment shops provide a more traditional avenue for selling second-hand goods.